On 5 June 2024, Ventura Offshore’s shares started trading on Euronext Growth Oslo under the ticker code “VTURA”. The stock jumped over 35% on the first day of trading, closing at NOK 28.5. It then stabilized at a slightly lower level, closing the week on 7 June at NOK 28 (+30.8%).

On 8 March 2024, the company entered into a share purchase agreement with Petroserv Marine regarding the acquisition of all outstanding shares in Universal Energy Resources Inc. for NOK 2.8 billion. Through the acquisition, the company acquired a contractor that has operated in the deep water drilling industry for 25 years.

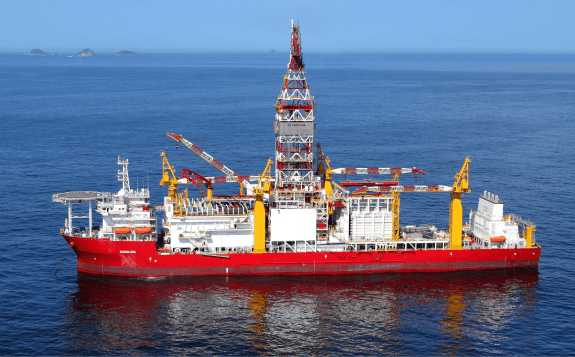

Following the closing of the acquisition on 8 May 2024, the Ventura Offshore owns and operates one drillship, Carolina (built in 2011), and one semisubmersible drilling rig, Victoria (built in 2009). Both are so-called 6th generation units built by South Korea’s DSME. They have contracts until spring 2026 with Brazil’s state giant Petrobras, at $208,000 per day.

Additionally, Ventura manages one drillship, Zonda, and one semisubmersible drilling rig, Catarina.

“We are excited to bring this company to the public market. It is a well-managed company with a strong asset base and a solid position in the Brazilian deepwater market. We have an excellent operational platform, and the listing gives us further flexibility to pursue various growth opportunities, primarily in the ultra-deepwater space”, said Ventura Offshore Chairperson, Gunnar Eliassen.

After years of a protracted downturn driven by global and local headwinds in Brazil, Petroserv went through a restructuring that included selling and scrapping rigs. Eventually, the firm was taken over by creditors in 2022. They were the sellers to the Norwegian group which is now taking the company on the stock exchange. They include Christen Sveaas as the largest owner, as well as Arne Fredly and Espen Westeren as significant shareholders of the company. Westeren and Eliassen have both worked under shipowner John Fredriksen in the past.

According to Norwegian newspaper Dagens Næringsliv, the top ten shareholders together own 70.6% of the shares in the company. In addition, 4.25 million options have been issued to the “sponsors” who helped finance a deposit in connection with the March acquisition, and those who have worked directly on the transaction. The deposit was 28 million dollars. The options, which are so-called “warrants”, can turn out to be favorable: They give the right to subscribe for shares at just one cent each in US dollars, or just over ten cents in NOK. Among the sponsors were Fredly, Westeren and Eliassen.

The investors raised in total 300 million dollars, of which 170 million dollars in equity and 130 million dollars in bond debt.

“The public listing of Ventura Offshore is an important milestone in our 25-year history and will provide exciting opportunities for the company going forward. With the strong support of new shareholders, the existing Ventura Offshore management and I are excited to progress the Ventura Offshore organization into its next chapter”, said Ventura Offshore Chief Executive, Guilherme Coelho.

In an interview with DNB, Mr. Coelho added that “the rigs can operate anywhere. But if you look at the Brazilian market, 3 years ago there were 21-22 rigs operating in Brazil. Now we are going to 36. So it is the market to be”.

The Macaé-based operations will continue with its existing management team and employees.

During the next five years, Brazil’s state-owned energy major Petrobras plans to allocate the biggest slice of its $102 billion investment pie to oil and natural gas investments. The two owned rigs got contracts with Petrobras in 2022, with Catarina on hire for Italian major ENI in Southeast Asia. The fourth, the drillship Zonda, belongs to the company Eldorado Drilling – another rig company with Norwegians as owners, including Petter Stordalen, Gunnar Hvammen and Harald Moræus-Hanssen. It will be delivered later this year, starting in early 2025 on a contract with Petrobras that runs to 2027.

As a small operator with “Tier 2” rigs, Ventura inherently carries more risk than larger peers. However, in Oslo, analysts are bullish. Arctic Securities analyst Sebastian Grindheim published a research report entitled “A Brazilian dream”, while Pareto Securities analysts Bård Rosef and Ole Martin Rødland called the company “cheap deepwater exposure”. Truls Olsen from Fearnley Securities is also long, saying that the owned rigs have tremendous repricing potential when their contracts expire in 2026. Rigs with similar specifications have recently secured contracts with Petrobras of 400,000 dollars per day and 340,000 dollars per day, respectively, for corresponding drillships and semi-rigs.