As the Antarctic Meetings are underway in Kochi, we’ll soon know the consolidated expedition cruise numbers for the 2023-2024 season. Total seaborne tourist count is expected to be around 117,000, according to an estimate by the International Association of Antarctica Tour Operators (IAATO) published last year.

The last actual numbers are from the 2022-2023 season with 104,076 passengers, the first time the psychological 100k barrier was crossed and an all-time high. The record sparked quite a lot of discussion about the sustainability of polar tourism and is up from 55,489 in the 2018-2019 season, the last one completely free from Covid-19 disruptions. This is an 88% total growth over 4 years, or a 17% compound annual growth rate. That seems like a pretty good business.

However, vessel supply is also growing fast.

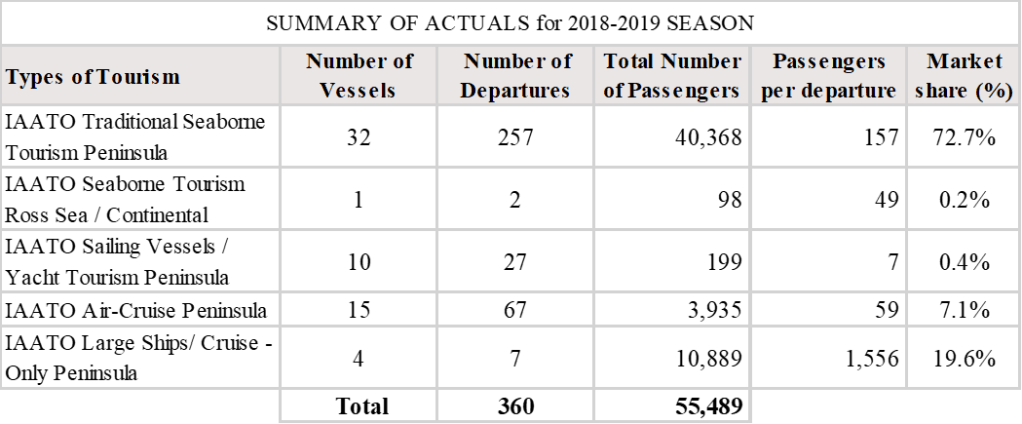

There are five distinct but connected expedition cruise ship services in Antarctica, according to the IAATO. The tables below consolidate the numbers.

The “Traditional Seaborne Tourism Peninsula” comprises smaller expedition ships that land passengers in the Antarctic Peninsula and surrounding islands, the most accessible part of Antarctica. There were 32 ships operating in this segment in 2019, carrying a total of 40,368 passengers in 257 departures, or 157 passengers per departure on average. In 2024, 49 ships are expected to carry 71,165 passengers on 445 sailings, a small 1.8% change in group size despite larger vessels being phased in. This might indicate deteriorating occupation rates, even in a market that grew 76.3% in 5 years. In addition, the other segments have grown even more, meaning the traditional Peninsula itineraries have lost a sizeable market share.

The “Seaborne Tourism Ross Sea / Continental” is similar to the first segment, but the anchorages are more remote. It is a smaller niche, but the one growing the fastest at 1,093% in 5 years. This is to be expected as Antarctica is a vast continent and there are many restrictions on disembarkation, such as off-limits areas and the cap of 100 guests ashore at a time in a particular spot. So the core Peninsula market is growing and is still relevant, but operators are diversifying to take guests elsewhere on the continent. We should expect this trend to continue.

The “Sailing Vessels / Yacht Tourism Peninsula” is operated by small sailing boats with a maximum capacity of 12 passengers. A tiny (and shrinking) market, at least for IAATO-affiliated boats.

The “Air-Cruise Peninsula” segment is made up of vessels that have their guests flying in at least one leg across the Drake Passage. The ships thus remain in the peninsula for the whole itinerary or travel across the dangerous strait only once per trip. This makes the tours more comfortable and faster but more expensive for the guest. Although the number of vessels in the segment decreased, capacity increased because newer and bigger ships entered the market. Still, in 2019 around 7% of Antarctic cruisers chose this alternative, while the number was expected to decrease to 5% this year. But will that actually be the case? We’ll get back to that.

Finally, the “Large Ships/ Cruise – Only Peninsula” is comprised of much larger vessels that usually don’t look like expedition cruise ships but like conventional ones. They have a less sophisticated ice class and due to their size and potential impact on nature, do not allow passengers to disembark. It’s a panoramic, much cheaper experience. But it has proven popular. There are now twice as many vessels in this segment as 5 years ago, with a quite substantial passenger market share climb from 19.6% to the projected 33.3%. In most Antarctic expedition cruises, it is not possible to pay less than 1,000 dollars per day as a guest. In these larger vessels, there are offerings as low as 200 dollars per day in a balcony cabin on larger itineraries, such as a 14-night roundtrip from Buenos Aires to the Antarctic Peninsula and back, or from Buenos Aires to Santiago with a stopover in Antarctica.

Before we conclude, let’s just review the case of air-cruises.

During the 1Q2024 earnings call on April 30, 2024, Sven Lindblad, founder and CEO of Lindblad Expeditions (NASDAQ: LIND), said that “there’s an overwhelming number of ships” in Antarctica. Lindblad has recently phased in the newbuilds National Geographic Endeavour and National Geographic Resolution, which depressed demand for the older National Geographic Explorer. The solution? Fly-cruises! He further elaborated: “there’s a natural inclination on the part of people who want to buy something that’s new. So, the ships were doing well, and the Explorer was lagging a little bit behind just because she was older and not the new thing. So, what we did is we created a whole different program incorporating the flying into Antarctica, allowing people with less time to go there. And that was the perfect counterpoint to the dilemma. We didn’t like discounting it. We just changed the idea. And people just bought it and it filled up instantly”.

This interesting backstory reveals the inner workings and rationale behind another heavyweight player moving into air-cruises in Antarctica. The move was announced by a press release back in January, with chief commercial officer Noah Brodsky adding to Seatrade Cruise News that “we’ve already seen a surge in demand”. This move was not predicted in the IAATO estimates from last year, so one might expect that the fly-cruises market share to be closer to the historic trend of 7%. A higher growth is corroborated by data from the Junta de Aeronáutica Civil, the Chilean civil authority that oversees the country’s aviation industry. The 2023 air traffic from Punta Arenas to Antarctica is up 28.2% from pre-Covid levels (2019), reaching an all-time high of 6,914 inbound passengers. The growth was a stunning 94.6% from 2022. Not all of that traffic is for fly-cruises, there are also scientists and day-trippers in the numbers. But the vast majority is.

There are also distinct approaches to the combined air-cruise offering. While Lindblad is allocating older tonnage, the company that invented the concept in 2003, Antarctica21, is doubling down on newbuilds tailored to it. After taking delivery of the Magellan Explorer for the 2019-2020 season just before the pandemic, the firm has ordered again at Asenav a sister ship, the Magellan Discoverer. The ship is expected to join Antarctica21’s fleet before the 2026-2027 season. Still, the company is not alone, as Aurora Expeditions, Quark Expeditions and Silversea Cruises have also deployed new vessels to the fly-and-sail expedition concept.

This time we have told part of the story. Next time, with the actual 2023-2024 numbers, we’ll look at occupancy and earnings. One thing is to operate a ship 70% full while charging 400 dollars per passenger per day, while another thing altogether is reaching a 90% occupancy while charging 1,500 dollars. As we all know, most rational operators are optimizing for earnings, not passenger count.

Usually, people discuss the environmental sustainability of Antarctic expedition cruising, which is fair enough. But what about financial sustainability? Does Mr. Lindblad have a point that vessel supply is “overwhelming”? Maybe the 17% annual growth rate will soon collapse. Could overcapacity in the long run put pressure on profitability and, as a result, on safety? Stay tuned.